These losses are not subject to the 2 limit on miscellaneous itemized deductions.

Deductions not subject to the 2 floor.

Deductions for attorney accountant and preparer fees are limited on schedule a of form 1040.

Thus you should not need to make additional entries as other current year decreases.

Report other miscellaneous itemized deductions on form 1041.

2 percent floor on miscellaneous itemized deductions.

To figure the amount of his deduction tony would.

There are two types of miscellaneous deductions.

Payments to obtain duplicate stock certificates go here.

The irs issued final regulations on the controversial question of which costs incurred by trusts and estates are subject to the 2 floor on miscellaneous deductions under sec.

You cannot simply reduce your gambling winnings by your gambling losses and report the difference.

1000 100 50 1150 line 23 of schedule a figure 2 of his agi.

Shall prescribe regulations which prohibit the indirect deduction through pass thru entities of amounts which are not allowable as a deduction if paid or incurred directly by an individual and which contain such reporting requirements as may be.

1150 600 550 line 26 of schedule a.

Miscellaneous deductions are deductions that do not fit into other categories of the tax code.

2 percent floor on.

Miscellaneous itemized deductions are those deductions that would have been subject to the 2 of adjusted gross income limitation.

1 deductions subject to the 2 limit these deductions allow you to deduct only the amount of expense that is over 2 of your adjusted gross income or agi.

Those that are subject to the 2 on line 15b of form 1041 is the place for all other miscellaneous deductions.

Investment advice safe deposit box rentals service charges on dividend reinvestment plans and travel expenses.

02 x 30 000 600 line 25 of schedule a subtract 2 of his agi from his deductions that are subject to the rule.

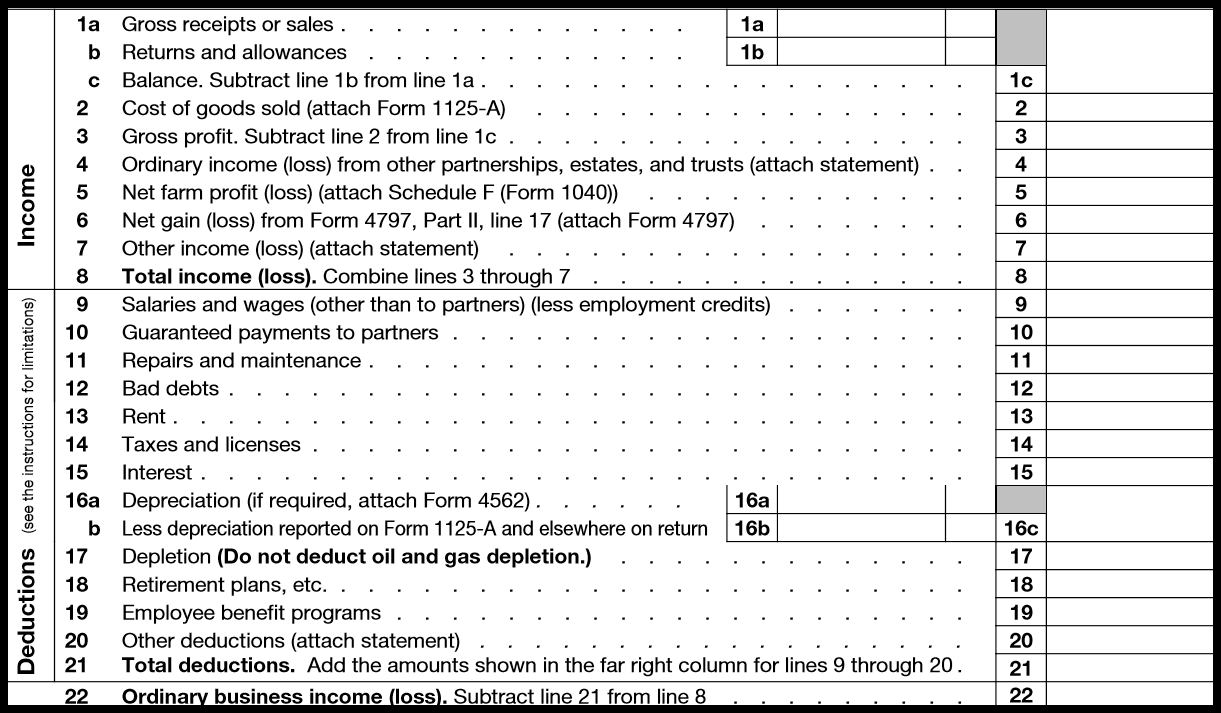

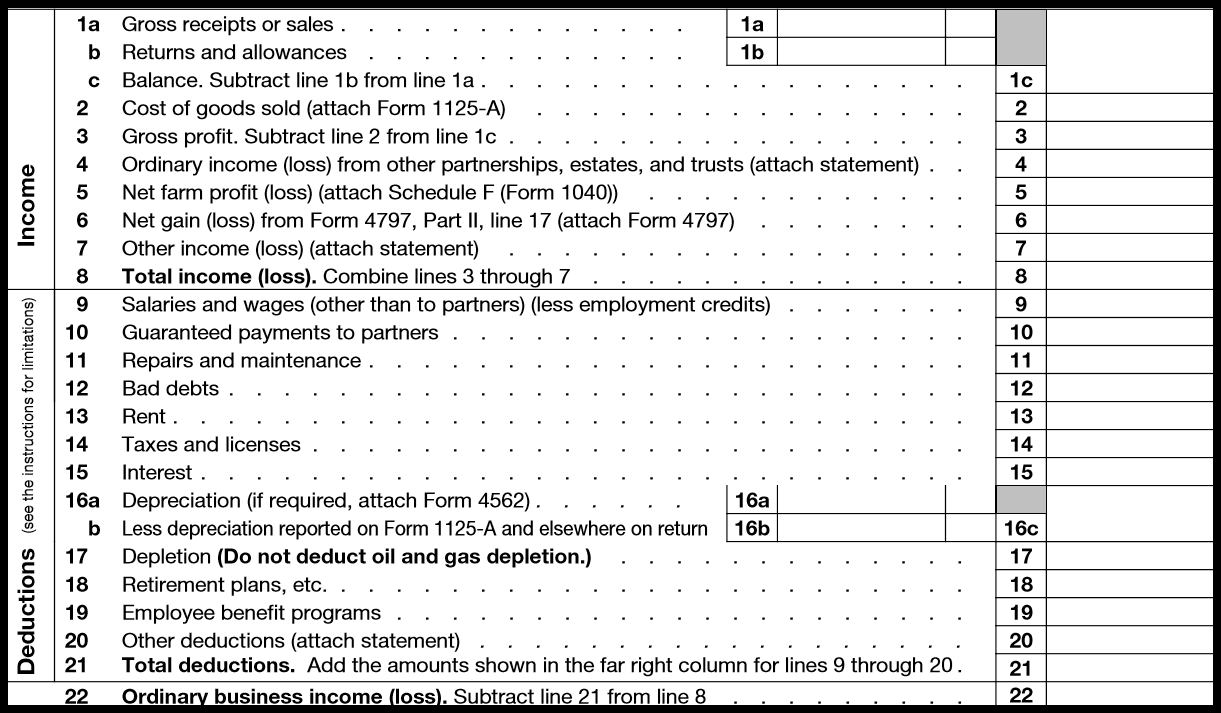

In prior years amounts subject to the 2 floor on line 13 of sch k 1 would have been coded with a k.

This code has been deleted.

Miscellaneous itemized deductions subject to the 2 floor aren t deductible for tax years 2018 through 2025.

You must report the full amount of your winnings as income and claim your losses up to the amount of winnings as an itemized deduction.

This publication covers the following topics.

Add up the deductions that are subject to the 2 rule.

Many of these deductions will be subject to the 2 percent exclusion where only amounts greater than 2 percent of adjusted gross income can be deducted.

The regulations will apply to tax years beginning on or after may 9 2014.